Welcome to Title Success!

We are the industry's most connected resource for mergers, acquisitions, valuations and much more.

If you're looking to sell, we will find you a buyer. If you'd rather expand, we'll help you execute the deal.

We also have attorneys on the team to set up compliant joint ventures and much more.

If you're looking to sell, we will find you a buyer. If you'd rather expand, we'll help you execute the deal.

We also have attorneys on the team to set up compliant joint ventures and much more.

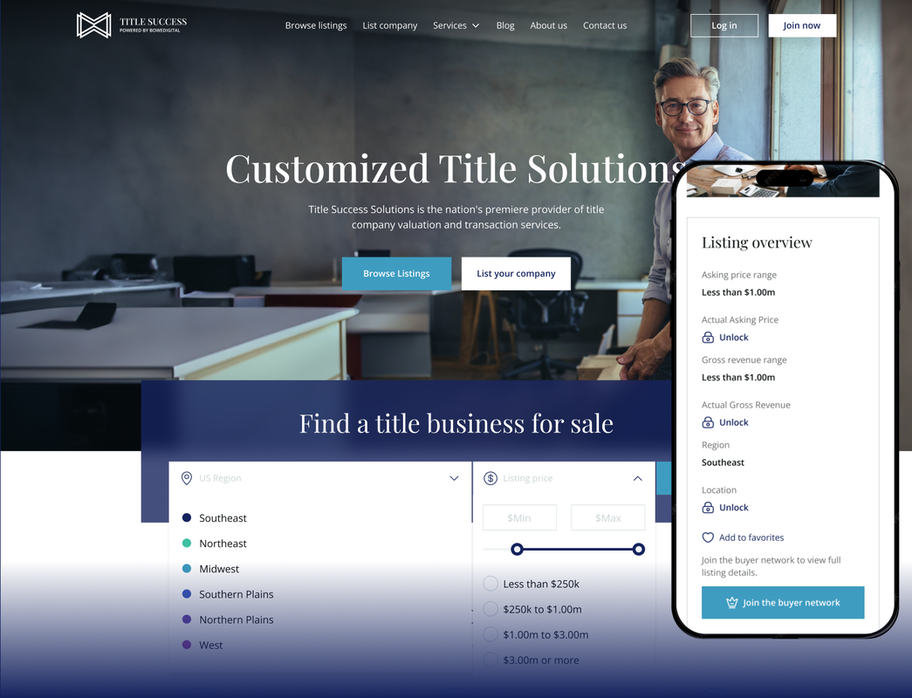

Coming Soon: Title Industry's First Business Listing Site

Title Success is thrilled to announce its upcoming website, meticulously designed to be your one-stop destination for title company valuation and transaction services in the nation. Scheduled to launch in Q4 2023, our platform is the first of its kind, solely dedicated to streamlining the buying and selling process of title companies.